Sending money worldwide has become instantaneous thanks to online money transfers, but this technological revolution has a rich and surprising history. TRANSFERGRATIS explores the fascinating evolution of money transfers.

Sommary :

INTRODUCTION

I. The Beginnings: Telegraph and Money Orders

- Network of Offices

- Sending Instructions

- Notification and Withdrawal

II. The Arrival of Digital Pioneers

- SWIFT (1973)

- First Virtual Holding (1994)

- PayPal (1998)

III. The Revolution of Mobile Apps and FinTech

- Rise of Mobile Applications

- FinTech: Innovation for Financial Inclusion

- Impacts and Challenges

IV. Key Factors in this Evolution

- Advanced Technologies

- Socio-economic Factors

- Competitive Factors

- Regulation and Trust

V. The Future of Online Money Transfers

- Blockchain and Cryptocurrencies

- Artificial Intelligence

- Open Finance

- Financial Inclusion

- Challenges and Opportunities

CONCLUSION

Imagine a world without the ability to instantly send money across the globe, a world where financial borders seemed insurmountable.

That world was ours just a few decades ago. The advent of online money transfers, a silent revolution, has transformed our lives and reshaped the global economic landscape. But this major innovation did not happen overnight. It is the result of a long journey of technological and social evolution, a fascinating saga that deserves to be traced.

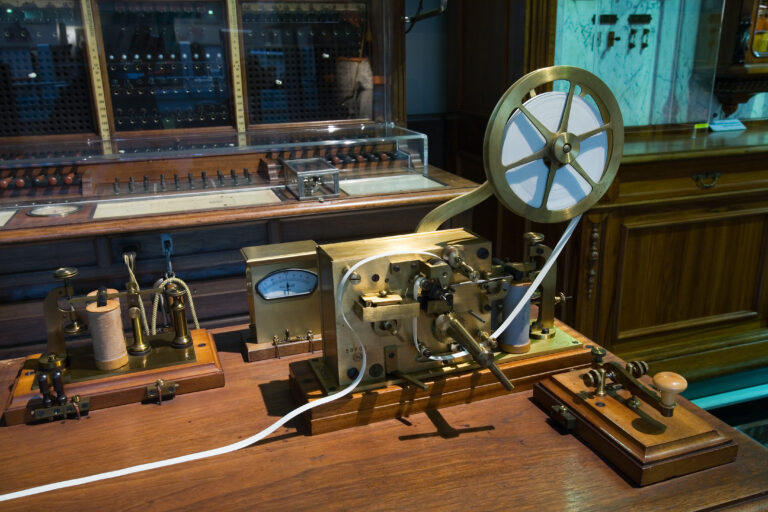

I / The beginnings: the telegraph and money orders (19th century)

Before the internet, the telegraph was the fastest means to transmit information, including payment instructions.

It was a system designed to send messages, known as telegrams, from one point to another over long distances using codes for quick and reliable transmission.

While the telegraph itself could not physically transfer money, it revolutionized money transfers in the 19th century by serving as an instant messenger for payment instructions.

1- Network of Offices

A network of offices refers to a set of physical locations owned by a single company or operating in partnership, where customers can send and receive money.

By the late 19th century, companies like Western Union had established an extensive network of telegraph offices in various countries and cities by the 1870s.

2- Sending Instructions

A sender would go to an office and pay the transfer amount, plus fees, while providing the recipient’s details.

The office would then telegraph a coded message to the receiving office, authorizing them to pay out the corresponding amount to the beneficiary.

3- Notification and Withdrawal

The receiving office would notify the beneficiary, who would then present identification to withdraw the funds.

II / The arrival of digital pioneers (late 20th century)

The digital pioneers of money transfer paved the way for the revolution we know today, harnessing the emerging power of computing and the Internet. Here are some key players and their notable innovations:

1- SWIFT (Society for Worldwide Interbank Financial Telecommunication) founded in 1973

SWIFT is a transfer network used by banks to securely communicate with each other, particularly for providing instructions regarding fund transfers between accounts.

SWIFT was developed in response to its predecessor, the inadequate Telex system. Telex was an old communication system used by financial institutions.

Considered impractical and prone to errors, Telex had long processing times. The SWIFT network was established in 1973 in Brussels, initially involving 239 financial institutions from 15 countries. Four years later, it expanded to include 518 institutions from 22 countries.

Currently, the SWIFT network is utilized by over 11,000 banking institutions across more than 200 countries.

Innovation: Replacing the paper-based fund transfer system and Telex with a secure electronic messaging network for financial institutions.

Impact: Significantly accelerated cross-border transactions and substantially reduced errors. SWIFT has become the standard for international transfers between banks.

2- First Virtual Holdings founded in 1994

Founded in 1994, First Virtual Holding was one of the first online payment companies. In 1998, First Virtual exited the online payment sector to focus on email services and internet messaging.

• Innovation: The company offered entirely electronic money transfers via the internet. Customers communicated their payment information via email, First Virtual processed the transaction, and notified the merchant via email to ship the goods.

• Impact: Despite limited internet penetration at the time, First Virtual paved the way for online payments.

3- PayPal founded in 1998

PayPal is an American company providing international online payment services. The platform serves as an alternative to payment by check or credit card.

Formerly known as Confinity, it was launched in December 1998 by the software development company specializing in security for handheld devices of the same name. Following the merger in 2000 between Confinity and X.com, PayPal went public in 2002 and became a leading online payment platform.

• Innovation: An online payment platform allowing users to link their bank accounts or credit cards to easily send and receive money.

• Impact: Democratization of online payments, simplification of e-commerce, and exponential growth in online transactions between individuals.

These pioneers, despite different technological and adoption contexts, shared a common vision: to eliminate geographical and technological barriers to facilitate the movement of money. They laid the foundation for today’s digital money transfer ecosystem, paving the way for further innovations.

III / The revolution of mobile applications and Fintech (21st century)

The 21st century has witnessed the emergence of a true revolution in the field of money transfers, driven by the convergence of two major forces: mobile applications and fintechs. This new wave has not only transformed the user experience but also access and financial inclusion, pushing the boundaries of what’s possible.

1- The rise of mobile applications

• Accessibility and portability: Smartphones have become ubiquitous tools, providing instant and convenient access to financial services.

• Simplification of transactions: User-friendly interfaces, intuitive processes, and multiple payment options (credit cards, bank accounts, e-wallets) have made transfers simpler than ever.

• Transparency and tracking: Users can track in real-time the status of their transfers, exchange rates, and associated fees.

2- FinTech: Innovation Serving Financial Inclusion

Alternatives to Traditional Banks: Startups like TransferWise, WorldRemit, and TRANSFERGRATIS have developed digital platforms enabling international transfers at competitive exchange rates and reduced fees.

Financial Services for the Unbanked: Innovative solutions have democratized access to financial services for millions of people without bank accounts.

Microfinance and Loans: FinTech platforms facilitate access to microloans, loans, and insurance for entrepreneurs and low-income individuals.

3- Impact and Challenges

• Increased financial inclusion: Mobile technologies and fintech have helped reduce inequalities in access to financial services, especially in developing countries.

• Cost and time reduction: Money transfers have become faster and cheaper, promoting international trade and family remittances.

• Security and privacy: Protecting personal data and combating fraud remain significant challenges in the digital money transfer ecosystem.

The alliance between mobile applications and fintechs has triggered a profound transformation of the money transfer landscape, making transactions faster, more affordable, and more accessible than ever before.

IV / Key factors of this evolution

The evolution of online money transfers is the result of a convergence of technological and socio-economic factors. Here are some of the key drivers of this transformation.

1- Technological advancements

• Internet and bandwidth: The rise of the Internet and increased bandwidth have enabled faster and more reliable communications, facilitating online financial transactions.

• Smartphones and mobile applications: The proliferation of smartphones and mobile apps has made financial services accessible to a broader audience, anytime and anywhere.

• Cryptocurrencies and blockchain: The emergence of blockchain and cryptocurrencies provides decentralized and secure solutions for cross-border transactions, opening up new possibilities.

2- Socio-economic factors

• Globalization and migration: The increase in migration flows and globalization of trade have heightened the demand for fast and cost-effective international money transfers.

• Financial inclusion: Access to financial services for unbanked and low-income populations has become a priority, driving the development of more inclusive digital solutions.

• Demand for transparency and traceability: Consumers seek financial services that are transparent and traceable, promoting the adoption of online platforms offering better visibility into transactions.

3- Competitive factors

• Cost reduction: Increased competition among traditional banks, fintechs, and mobile operators has led to a decrease in money transfer fees, encouraging the adoption of digital services.

• Innovation and service diversification: Money transfer service providers are diversifying by offering additional services such as loans, insurance, and investments, creating a more comprehensive and appealing range of offerings.

4 - Regulation and Trust

• Clearer Regulatory Frameworks: The adoption of specific regulations for online money transfer services has increased consumer trust and ensured transaction security.

• Combatting Fraud and Money Laundering: Continued efforts to combat fraud and money laundering enhance the security and credibility of online money transfer services.

• Globalization: Increased population mobility and international trade have created a strong demand for cross-border money transfers.

• Technological Innovation: Internet, smartphones, and encryption technologies have made money transfers faster, cheaper, and more secure.

• Regulation: Stricter regulations on money laundering and terrorism financing have led to the creation of more robust identity verification systems.

In terms of international regulatory frameworks, we have…:

FATF (Financial Action Task Force on Money Laundering) : Intergovernmental organization that establishes international standards to combat money laundering and terrorist financing. These standards are implemented by member countries and influence local regulations.

GAFI (Groupe d’Action Financière sur le Blanchiment des Capitaux): French equivalent organization to FATF, playing a significant role in the establishment of anti-money laundering regulations.

At the national and regional regulatory levels:

• USA: Financial Crimes Enforcement Network (FinCEN) and the Bureau of Consumer Financial Protection (CFPB) establishes rules for money transfer businesses, including identity verification requirements and fraud prevention.

• European Union: The Payment Services Directive (PSD2) and the General Data Protection Regulation (GDPR) govern online money transfers in the EU, emphasizing data security and consumer protection.

• Africa: Regional organizations like the East African Financial Services Regulatory Authority (EAFSRA) establish standards and guidelines for online money transfers in the region.

V / The future of online money transfers

The future of money transfers looks exciting, marked by a convergence of profound technological and societal trends. Here’s an overview of the perspectives and key innovations.

1- Blockchain and cryptocurrencies

• Decentralized and Secure Transactions: Blockchain provides a trusted and transparent solution for money transfers, reducing costs and processing times, especially for cross-border transactions.

• New Digital Currencies: Cryptocurrencies like Bitcoin and Ethereum offer new possibilities for instant and borderless money transfers, though their volatility remains a challenge.

• Stablecoins: Cryptocurrencies “pegged” to traditional assets like the US dollar provide a more stable alternative to digital currencies.

2- Artificial Intelligence (IA)

• Personalization and automation: AI can analyze data and personalize user experiences, optimize exchange rates, predict needs, and automate transaction processes.

• Fraud detection: AI can identify fraudulent transactions in real-time, enhancing security and reducing losses.

3- Open Finance

• Data and application sharing: Open Finance will enable users to share their financial data with third parties, paving the way for innovative money transfer and financial management services.

• New financial ecosystems: Interoperability between platforms will create more comprehensive and personalized services, integrating money transfer solutions with banking, insurance, and investment services.

4- Financial inclusion

• Increased access: Digital technologies will continue to democratize access to financial services, enabling unbanked individuals to participate in the global economy.

• Microfinance and micro-payments: Money transfer technologies will facilitate access to microloans, micro-payments, and financial services for low-income populations.

5- Challenges and opportunities

• Security and privacy: Data protection and fraud prevention remain significant challenges, necessitating robust technological solutions and appropriate regulations.

• Harmonization of regulations: Clear and harmonized regulations across countries are essential to facilitate the development and adoption of digital money transfers.

• Education and adoption: Public awareness of the benefits and usage of money transfer technologies is crucial for widespread adoption

The history of online money transfers is far from over. It is constantly evolving, driven by innovation and the ambition to create a more inclusive and accessible financial system. Blockchain technology, with its disruptive potential, promises to further democratize money transfers, making them not only faster and cheaper but also more transparent and secure. Financial inclusion, especially in developing countries, is another major challenge that industry players are striving to address. By facilitating access to financial services for the unbanked populations, online money transfers contribute to poverty reduction and economic development.

The saga of online money transfers is thus the story of a silent revolution that has already transformed our lives, but whose potential for positive impact on the world is far from exhausted. At a time when physical borders fade away thanks to technology, financial boundaries also appear on the verge of collapsing, paving the way for a future where money will flow freely and equitably.