International money transfers, also known as remittances, are funds sent by migrants to their countries of origin and play a crucial role in addressing global inequalities. Remittances from migrants to their home countries remain one of the primary sources of external financing for poor countries. In 2023, remittances reached a record amount of approximately $669 billion, according to the World Bank. In 2024, the multilateral institution projects a further increase of 3.1%, bringing total remittances to $690 billion. This article of Transfergratis explores how these financial flows contribute to improving living conditions, stimulating economic development, and reducing inequalities within societies.

I - The economic impact of money transfers

Money transfers have a direct impact on reducing inequalities. By providing poor families with additional financial resources, they help bridge the gap between the rich and the poor. The benefits extend beyond just the direct recipients; they can also have multiplier effects by stimulating local economies and creating economic opportunities for a broader population.

Moreover, remittances play a crucial role in the economic resilience of local communities during times of economic crisis or external shocks. They can help mitigate the negative effects of financial crises or natural disasters by providing a reliable and stable source of income to affected families.

A - Vital support for low-income households

Remittances are a crucial source of income for many families, particularly in developing countries. These funds, often sent by expatriate workers, help recipients cover basic needs.

For example, in countries like the Philippines, remittances account for up to 10% of GDP. Many families use these funds to pay for food, healthcare, and education, thereby improving their quality of life.

B - Stimulus for consumption and the local economy

The funds received by families through remittances are typically spent locally on essential goods and services. This influx of funds stimulates domestic consumption and supports local small businesses. According to the World Bank, remittances often account for a significant portion of national income in many developing countries, thereby contributing to economic stability and long-term growth (World Bank, 2022).

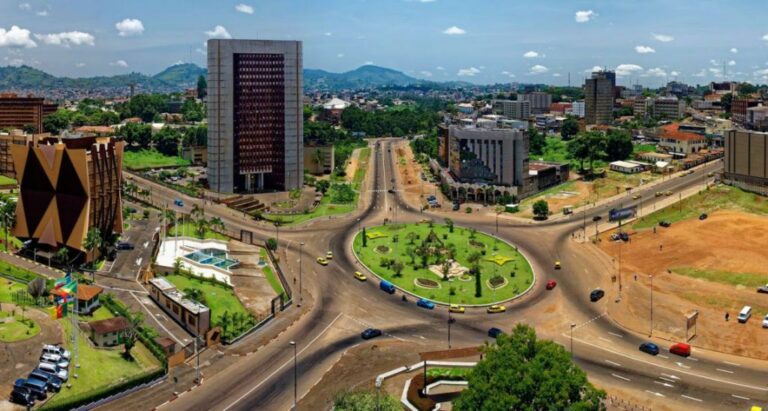

For example, in Ghana, studies have shown that remittances have led to an increase in local consumption and have helped in the creation of new businesses. These financial flows promote inclusive economic development.

C - Reducing dependence on external aid

Remittances can reduce developing countries’ reliance on foreign aid by providing an alternative and more predictable source of funding. This enables countries to have better control over their economic future and implement more autonomous economic and social policies.

From a macroeconomic perspective, remittances also represent a significant inflow of foreign currency into the recipient countries’ economies. This can bolster foreign exchange reserves, stabilize the local currency, and stimulate domestic consumption, which in turn can drive economic growth.

Example: In Nigeria, remittance-funded projects have improved access to clean water and healthcare in remote villages, thereby increasing community resilience.

Remittances contribute to the economic development of developing countries by aiding job creation, expanding small businesses, and reducing dependence on foreign aid.

II - Challenges and considerations

International money transfers, while beneficial for reducing inequalities, present both significant challenges and opportunities. Here is an analysis of the key challenges and opportunities associated with these transfers:

1 - Challenges of Money Transfers in Reducing Inequalities

High transaction costs: The fees for sending remittances can be prohibitive, especially for small amounts. These costs often reduce the net amount received by beneficiaries and can therefore limit their real impact on reducing inequalities.

Excessive dependence: Over-reliance on remittances can create long-term economic imbalances by discouraging the development of more diversified and resilient local economic sectors. This can lead to increased vulnerability to external economic shocks.

Risks from exchange rate fluctuations: Exchange rate variations can significantly affect the real value of remittances received by beneficiaries. This can make money transfers less predictable and reliable as a source of income.

Financial exclusion: In some areas, particularly rural or marginalized communities, access to basic financial services can be limited. This can make it difficult for some beneficiaries to access and effectively use remittances to improve their economic situation.”

2 - Opportunities of Remittances in Reducing Inequalities

- Direct support to vulnerable families: Remittances provide direct financial support to households in developing countries, helping to meet basic needs such as food, housing, education, and healthcare. This directly contributes to poverty reduction and inequality alleviation.

- Stimulating local consumption and economy: Funds received by beneficiaries are often spent locally, which stimulates domestic consumption and supports local small businesses. This can foster economic growth and job creation at the community level.

- Reducing economic risks: By providing a stable and predictable source of income, remittances can help families mitigate the risks of extreme poverty and enhance their economic resilience against external shocks such as financial crises or natural disasters.

- Promoting financial inclusion: Remittances also play a crucial role in promoting financial inclusion by enabling recipients to access basic financial services such as savings accounts, loans, and insurance. This can improve their ability to invest in productive economic activities and increase their long-term income.

Remittances play a fundamental role in reducing global inequalities by supporting low-income households, stimulating local economic development, and balancing regional disparities. By improving access and reducing associated costs, it is possible to maximize the impact of these funds. For a fairer future, it is essential to recognize and support the potential of remittances in the fight against inequalities. Tailored policies and the integration of innovative technologies will be crucial in enhancing this positive impact. Discover how remittances are changing lives. Share this article and inspire others to act in reducing global inequalities.

Sources and References: World Bank, International Monetary Fund, Organisation for Economic Co-operation and Development, Les Échos.