Successfully managing your personal budget is one of the keys to achieving financial stability and realizing your life goals. This task is a real challenge, especially for young workers who have to juggle daily expenses, long-term projects, and unexpected costs. It can be a true struggle because it requires organization, discipline, and a clear understanding of one’s finances, which can quickly become overwhelming. Fortunately, technology comes to the rescue to simplify this complex task in everyday life. In this article, we present the five best budget management apps that can help you optimize your personal finances, whether it’s for vacations, paying off debts, sending money to loved ones, or simply keeping better track of your spending.

1 - Mint

Mint is undoubtedly one of the most popular budget management apps, and for good reasons. It allows you to consolidate all your finances in one place by syncing your bank accounts, credit cards, and loans. Here are some of the many benefits of using it:

- Automatic expense tracking: Mint automatically organizes your transactions into different categories, such as food, rent, or entertainment, making it easy for you to see where your money is going. For example, if you buy groceries for the week, Mint will categorize that under ‘food.’ This helps you clearly see how much you spend each month in each category.

- Alerts and reminders: The app notifies you when a bill is due, helping you avoid late payments. For instance, if you have an electricity bill to pay, Mint will send you reminders before the due date, and if you’re close to your budget limit, it will alert you as well. This helps you stay in control of your finances and avoid overspending.

- Visual analysis: With its charts and graphs, you can see how much money you’re spending, how much you’re saving, and how everything compares to your budget. For example, a graph might display your monthly expenses across different categories like food, housing, entertainment, and money transfers. This allows you to quickly identify where you’re spending the most and adjust your habits if necessary.

In short, this app is ideal for those who want an overview of their finances without having to manually enter every expense. The app is free and available on both iOS and Android.

2 - YNAB

YNAB is an app that goes beyond simple expense tracking. It helps you set financial goals and assign every dollar to a specific expense, allowing you to manage your money in a proactive and controlled manner. Here are some of the many benefits of using it:

- Planning-centric management: With YNAB, you decide in advance how to spend each dollar you earn. For example, instead of leaving money in your account with no purpose, you can choose to transfer it to your loved ones in Africa at the end of the month. This helps you avoid unexpected expenses.

- Training resources: The app offers free training on personal finance management to help you improve your money management skills. You can access courses, videos, or online resources that teach you important financial concepts such as budgeting, saving, and expense planning.

- Real-time sharing: YNAB features a function that allows multiple family members to share the same budget. This way, everyone involved can see and manage shared finances collaboratively. For instance, if you and your partner are managing a budget together, you can both add your incomes, expenses, and financial goals in the app. This facilitates communication about spending, allows everyone to track where the money is going, and helps make financial decisions together.

This app is paid, but it offers a 34-day trial period and is available as both a web version and mobile apps on iOS and Android. It is particularly recommended for those looking to take rigorous control of their finances.

3 - PocketGuard

The app connects to your bank accounts and shows you in real time how much you can spend while staying on track with your savings goals and paying your bills. It also offers several benefits:

- Expense and subscription tracking: PocketGuard helps you identify your subscriptions and shows you which ones you might consider canceling to save money.

- Automated budgeting based on your habits: Instead of having to manually create a budget, the app analyzes what you earn each month and how much you typically spend in different categories. For example, if you usually send $200 to your little sister in Africa each month, the app will take this into account to establish a budget that allows you to spend a similar amount in the future.

It’s an excellent app for those who want a clear and simple view of their available money while avoiding unpleasant surprises at the end of the month. PocketGuard is available for free, with paid premium features.

4 - Goodbudget

Goodbudget is an app that takes inspiration from a classic method called the envelope system. In this method, you use physical envelopes to allocate money for each spending category, such as food, rent, family, or leisure. With Goodbudget, you do the same thing, but digitally. Its use also offers several advantages:

- Envelope approach: The idea is to divide your money into different virtual envelopes. Each envelope represents a spending category. For example, you might have an envelope for household expenses, one for groceries, and another for leisure.

- Budget sharing: Goodbudget is also perfect for couples, as it allows them to manage their finances together transparently. For instance, if one partner buys groceries and records the expense in the app, the other can immediately see how much money is left in the grocery envelope.

- Manual account management: Goodbudget is different from other budgeting apps because it does not connect to your bank accounts. This means you don’t have to share your banking information with the app. Instead, you manually enter your income and expenses.

Goodbudget is a more secure option for those who want to protect their privacy and avoid connecting their bank accounts to third-party apps. The app is available on iOS and Android, with a free version and a premium version for more advanced features.

5 - Spendee

Spendee is known for its intuitive interface and vibrant colors that make financial management more enjoyable. This app is ideal for managing your finances solo or in a group. The benefits include:

- Management of shared budgets: You can go on a trip with friends and create a shared budget for travel expenses such as accommodation, food, and activities. Each group member can contribute to the budget and track expenses in real time. This way, everyone knows how much money has been spent and how much is left, helping to avoid misunderstandings or disagreements over expenses.

- Customization of categories: You are not limited to the standard categories that some apps offer, allowing you to create categories that match your lifestyle exactly. For example, if you spend a lot on dining out, leisure, or even your streaming subscriptions, you can create categories like “Restaurants,” “Leisure,” and “Streaming” to track these expenses more accurately.

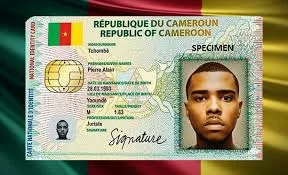

- Multi-currency tracking: If you are traveling from Canada to Cameroon, with Spendee, you can record your expenses in Canadian dollars and then switch to CFA francs during your stay in Cameroon. This allows you to see how much you are spending in each currency without having to perform complicated calculations. This feature gives you a clear overview of your finances, even when using multiple currencies.

This app is perfect for those who travel frequently. It is available on iOS and Android with a free version and a paid premium version.”

Optimizing your personal finances is now easier thanks to the multitude of budget management apps available. However, personal finance management is no longer just about monitoring your daily expenses; it also includes reducing unnecessary fees when sending money, and that’s where Transfergratis comes in!

Just like a good budgeting app helps you save daily, Transfergratis does the same for your international money transfers. The platform allows you to send funds from Canada to several countries in Africa quickly, for free, and only at the current exchange rate, with no hidden fees. This gives you complete control over what you send, allowing you to save and send even more money to your loved ones. Isn’t that great?

Download the app now it’s available on iOS and Android, and signing up is free too.

Feel free to share this article with your loved ones and check out our blog to discover the latest technological trends.