Money Transfers in the Digital Age: A Spotlight on Transfergratis and Its Promise of Fee-Free Transactions

International money transfers, a vital service for millions worldwide, are undergoing a profound transformation. Gone are the days when options were limited to bank counters with their exorbitant fees. The rise of financial technology (Fintech) has paved the way for faster, more transparent, and, above all, more economical solutions. At the heart of this revolution, innovative platforms are emerging, and among them, Transfergratis stands out with a bold proposition: money transfers with zero fees.

The Current Landscape of Remittance

Sending money to loved ones abroad, paying bills, or managing business remotely has become commonplace in our globalized economy. Historically, this market was dominated by traditional players like Western Union and MoneyGram, as well as conventional banking networks. While these services have the advantage of their extensive networks, they are often criticized for their high costs, which include fixed transaction fees and sometimes significant markups on exchange rates.

The emergence of online platforms and mobile applications has changed the game. Names like Wise (formerly TransferWise), Remitly, and Xe have earned user trust by offering more transparent fee structures and exchange rates closer to the real market rate. The trend is clear: consumers are looking for simplicity, speed, and, above all, value for money.

Transfergratis: The Fee-Free Transfer Revolution?

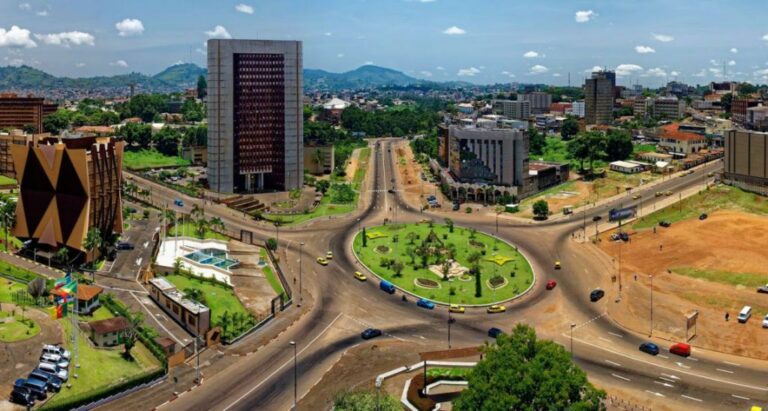

It is within this competitive landscape that Transfergratis operates, a company that, as its name suggests, has made fee-free transfers its main selling point. The platform currently focuses on sending money from Canada to several African countries, including Cameroon, Ivory Coast, Togo, Benin, and Senegal, with a promise to expand its services to other corridors.

The Transfergratis model is based on a simple principle: zero transfer fees. The company states that the amount sent in Canadian dollars is converted and delivered in full to the recipient, with no deductions. This appealing offer naturally raises a question: how does Transfergratis make money? The company indicates that it generates revenue through highly competitive exchange rates that remain very close to the interbank rate. The goal is to offer a rate more advantageous than that of banks and other traditional services, thus making the service attractive even without direct fees.

The user process is designed to be simple and fast. Transfers are initiated from the Transfergratis mobile app and funded via Interac e-Transfer, a widespread electronic payment method in Canada. Funds can be received in mobile money accounts or as a cash pickup, depending on the destination country.

Advantages Highlighted by Users

On app download platforms and its own website, Transfergratis features numerous testimonials from satisfied users. The most frequently mentioned strengths include:

- No Fees: This is the number one argument that attracts users who are tired of fees that reduce the amount sent.

- Speed: Many reviews highlight the speed of transactions, which are often completed in a matter of minutes.

- Ease of Use: The application is described as intuitive and user-friendly.

- Responsive Customer Service: The availability and efficiency of customer support are also frequently cited as positive points.

A Market in Full Swing

The arrival of players like Transfergratis demonstrates the vitality and constant innovation in the money transfer sector. The pressure on pricing and the demand for transparency continue to grow, pushing all providers, including the most established ones, to revise their offerings.

For consumers, this increased competition is excellent news. It gives them a wider choice of services that are better suited to their needs and available at increasingly advantageous terms. While the “zero fee” promise of Transfergratis must be examined in light of its exchange rates, it has the merit of challenging the status quo and raising the bar for the entire industry. The future of money transfers is being written today, and it seems to be heading towards ever-greater simplicity, speed, and accessibility.

Try Transfergratis today and optimize your international financial flows! The Transfergratis platform is a free, fast, and secure money transfer service from Canada to Africa. Download the app on the Play Store or the App Store.