Scams are acts of deception that exploit trust to achieve illegitimate gains. Scams do not merely manipulate individuals or businesses; they sometimes have global financial and social repercussions. According to a report by the Association of Certified Fraud Examiners, annual global losses due to financial fraud amount to approximately $5 trillion, a figure that far exceeds the GDP of many countries. The biggest scams in history are striking examples of how deception can reach astronomical proportions, leaving behind waves of ruin and scandal. In this article, we will explore some of the greatest scams of all time, revealing the fascinating details of each case.

1 - Charles Ponzi and His Cardboard Pyramid

Charles Ponzi, a Name Synonymous with Fraud

Born on March 3, 1882, in Lugo, Italy, and died on January 18, 1949, in Rio de Janeiro, Brazil, Charles Ponzi was an Italian con artist, best known for orchestrating an elaborate scam based on a chain of loans between 1919 and 1920. Although Ponzi did not originally invent this scam technique, it is so closely associated with him that it bears his name.

The Ponzi scheme is a type of financial scam that promises high returns to investors by using the money from new investors to pay returns to earlier investors, rather than actually investing the funds.

In 1919, Ponzi devised this scheme based on the idea of exploiting differences in exchange rates between international reply coupons, a type of voucher used for sending money internationally. By claiming that these coupons could be purchased cheaply abroad and sold at a higher price in the United States, he attracted significant investment. However, instead of investing the funds as promised, Ponzi used the money from new investors to pay returns to earlier investors, creating the appearance of high and rapid returns. When the fraud was uncovered in 1920, Ponzi had defrauded millions of dollars.

Exposed by the Boston Post and under multiple federal investigations, Ponzi surrendered to the authorities on August 12, 1920. He pleaded guilty and was sentenced to 5 years in prison. Released after three and a half years, he was deported to Italy, where he organized several small-scale scams before fleeing to Brazil, where he died in 1949.

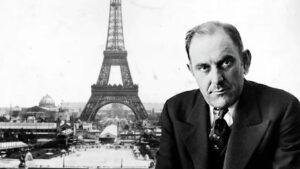

2 - Victor Lustig: The Man Who Sold the Eiffel Tower

Victor Lustig, born on January 4, 1890, in Hostinné, Kingdom of Bohemia, and died on March 11, 1947, in Springfield, Missouri, is primarily known as “the man who sold the Eiffel Tower” twice, claiming it was scrap metal.

In 1925, Lustig left the United States and traveled to France with one of his accomplices. While sitting in a café, Lustig happened to come across a newspaper article discussing the Eiffel Tower. The article mentioned that the tower, which was supposed to be dismantled after the 1889 World’s Fair, was proving more expensive to maintain than anticipated. The journalist ended the article with a pertinent question: “Should the Eiffel Tower be sold?” This was enough to inspire the devious con artist!

Lustig then wrote to several scrap metal dealers, posing as a representative from the Ministry of Posts, Telegraphs, and Telephones (PTT), and arranged meetings with them. During these meetings, he presented a “very secret” deal: the French government planned to dismantle the Eiffel Tower and was seeking bids from “the best scrap dealers in the region” to dispose of the construction materials.

Among the six dealers present, one man caught Lustig’s attention: André Poisson. Lustig convinced Poisson to pay a bribe to secure the contract. Poisson agreed, and Lustig and his accomplice promptly fled the country with the money.

Shortly after, the two swindlers returned to France to repeat the scam, but their new target did not fall for it and threatened to report them to the police. They were forced to flee hastily, and without any money. It should be noted that Lustig was not convicted for this crime.

Back in the United States and broke, Lustig began producing counterfeit money. Along with his accomplices, he flooded the American market with several million dollars in fake currency. For years, law enforcement struggled to capture Lustig. The con artist was reportedly arrested 47 times throughout his life but always managed to escape due to a lack of evidence.

In May 1935, he was arrested again and imprisoned at New York’s Federal House of Detention. This time, there was ample evidence. He remained there for several months but, as the FBI thought they had finally caught him, Lustig escaped once more using bedsheets as a rope. It wasn’t until September 1935 that he was finally apprehended for good, thanks to an anonymous tipster.

During his trial, Lustig was found guilty of circulating over $2 million in counterfeit money and escaping from a federal prison. He was sentenced to 20 years in prison, where he died on March 11, 1947, at the age of 57.

3 - Gregor MacGregor and His Imaginary Country

General Gregor MacGregor, born on December 24, 1786, and died on December 4, 1845, was a Scottish soldier, adventurer, and con artist who from 1821 to 1837 attempted to lure British and French investors and settlers to “Poyais,” a fictional territory in Central America that he claimed to govern.

On a territory granted to him in 1820, located between Honduras and Nicaragua, MacGregor invented a new Central American country called “Poyais,” of which he declared himself governor. He presented the area as a fertile land rich in resources, with an established community and infrastructure. To lend credibility to his claims, he produced false maps, fake currency, and even forged government documents.

The soldier managed to convince members of the European elite to invest in Poyais, and many settlers subsequently traveled to establish themselves there. Upon arrival, instead of finding the promised utopia, they encountered an uninhabitable jungle, leading to severe financial difficulties for most displaced families and the death of 150 settlers.

MacGregor’s elaborate scam relied on the lack of reliable communication of the time and the public’s limited knowledge of distant lands, allowing him to steal vast sums of money while ruining many lives. The man was never convicted for this injustice and was able to spend his final years in Venezuela, where he was honored by the government for his military career.

4 - The Bernard Madoff Scam

Bernard Madoff orchestrated the largest Ponzi scheme in modern history. His firm, Bernard L. Madoff Investment Securities LLC, promised high and consistent returns to its clients, but in reality, Madoff used the funds from new investors to pay the old ones.

Born on April 29, 1938, in New York and died on April 14, 2021, while imprisoned in Butner, North Carolina, Madoff defrauded thousands of investors of an estimated $65 billion over a period of at least 17 years. Madoff attracted investors by claiming to generate significant and stable returns through an investment strategy called split-strike conversion, a legitimate trading strategy. In reality, Madoff deposited his clients’ funds into a single bank account, which he used to pay existing clients who wished to withdraw their gains. He financed these payouts by attracting new investors and their capital.

This is the classic Ponzi scheme model: absorbing a constant flow of new funds while paying out enough to maintain the appearance of extraordinary returns. The fraud was inevitably exposed when the market experienced a sharp decline in late 2008, and too many clients sought to withdraw their money. On December 10, 2008, Madoff confessed his crimes to his sons, who worked at his firm. The following day, they turned him over to the authorities.

Bernard continued to claim that his sons and wife were unaware of his scheme. The final reports from the fund indicated that he had $64.8 billion in client assets. Madoff died in a federal prison hospital at the age of 82 on April 14, 2021, while serving a 150-year sentence for money laundering, securities fraud, and several other crimes.

The greatest scams in history reveal flaws in vigilance, transparency, and regulation. They show how deception can reach sophisticated levels and how weak control systems can be exploited. The lessons learned from these scams have led to significant reforms, strengthening regulations and control mechanisms to prevent future frauds. Vigilance remains essential to protect individuals and institutions from scams. By learning from past mistakes, we can enhance our resilience against future deceptions and maintain trust in financial and commercial systems.

Feel free to share this article with your loved ones and explore our blog for even more fascinating cases of fraud.

sources :